We have all heard of India’s rapid development in the past few decades. Its GDP per capita, PPP (in current international $) has grown from $1,237 in 1990 to $7,763 in 2018. I left India in 2002, and every year during trips back home to Delhi and Kolkata I would witness the transformation. While the development in my new home, the United States, was more or less static, the changes in India were constant and “in your face” – new malls, new consumer brands, massive increases in car and mobile phone ownership, to name a few. There was a sense of almost endless growth.

As India has developed, the opportunities for tech start-ups have grown significantly. As of last year, the number of tech start-ups in India clocked in around 9,000. According to Goldman Sachs, India is home to 560 million internet subscribers, 354 million smartphone subscribers, and the cheapest mobile data rates in the world (1 GB for $ 0.26). By 2025, 60 percent of Indians are projected to have internet subscriptions and smartphones.

How will technology advancement impact India in the coming decades?

To capture the full potential of technology, India’s national and sub-national governments will need to bridge the urban-rural digital divide by addressing barriers such as limited telecom infrastructure, language, slow internet speed, and low computer literacy. Nevertheless, the impact of technology will be undeniable.

While most of India will be connected in the coming decades, India is diverse beyond our imaginations. Start-ups should be careful of one size fits all approaches, as Indians fall in very different income segments than the West.

How do India’s income segments compare with other major players?

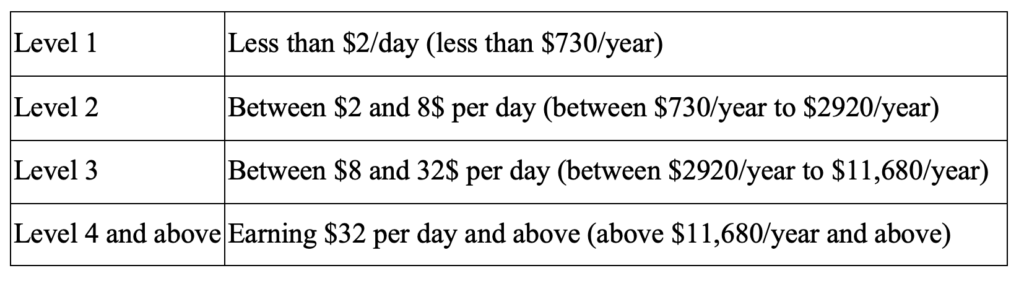

Hans Rosling’s work divides the world into four income levels based on household per capita income:

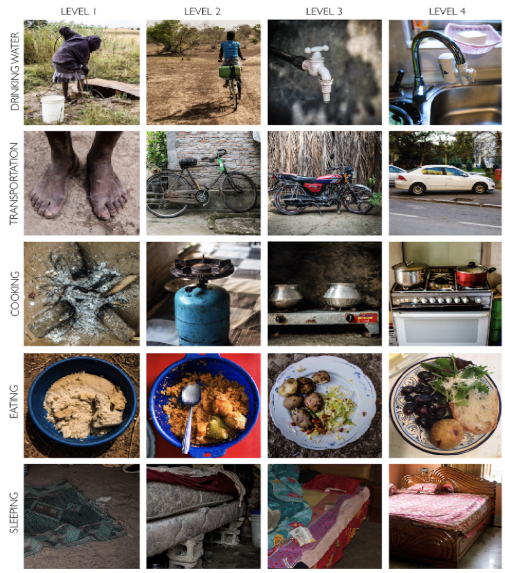

The image below gives an idea of how people in the different parts use transportation, cook, eat and sleep. People in Level 1 live in extreme poverty whereas people on Level 4 are the richest. Most of you reading this article are probably in Level 4.

Source: Gapminder

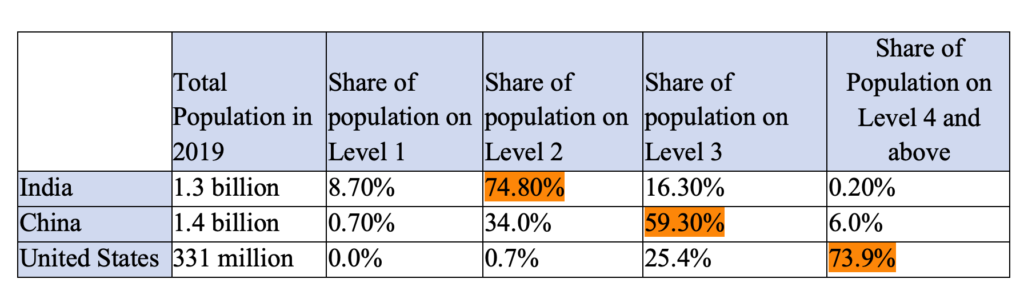

To give us some perspective, let’s compare India’s population and earnings in 2019 with China, which has a developing story like India, and the United States, the most developed part of the world.

Most of India is still on Level 2 (earning between $730/year to $2,920/year), whereas the majority of China is on Level 3 (earning between $2,920/year to $11,680/year) and the majority of United States is rich on Level 4 (earning $11,680/year and above). Above $11,680/year might not be considered rich to many reading this article, but it gives you perspective on where you stand with respect to the rest of the world.

The population on Level 2, where most Indians fall, are the rural laborers, the rural landowners, the urban blue collar and migrant worker segments. Whereas, the Indians on Level 4 are the rich class of around 2.6 million households, a tiny percentage of India’s total population. These folks have white collar jobs, are small and medium size business owners or are corporate big shots. Most Indians in Level 4 are concentrated in the $11,680 to $30,000 annual income range.

How do India’s income segments impact tech start-ups?

Most tech start-ups in India have targeted their customer base to the Level 4 consumers and the richer Level 3 consumers (earning above $5,500/year). These two groups represent a population of close to 45 million. This demographic is probably the one watching Netflix, using ride hailing services, shopping online, or ordering food through delivery apps. While these customers are more likely to have disposable income, they represent just a small slice of India. Once this market is capped, start-up founders in India are likely to find it difficult to expand into the “bottom of the pyramid” markets, which by their sheer volume merit greater consideration.

Where should start-ups and VCs focus in the coming years?

Graph adopted using the Gapminder Tool

As the graph above indicates, it will take another 20 years for most Indians to move towards Level 3. For comparison, most Chinese will remain on Level 3, with a significant portion moving to Level 4. In the United States, nearly 100% of the population will be on Level 4.

Given that start-ups do not have 20 years to wait, or they risk going under, VCs and tech start-ups should deepen their focus today on Level 2 consumer and the lower end of Level 3 consumers in addition to their focus on India’s richer segments. However, Level 2 and 3 consumers’ dreams, aspirations and incomes are very different from the consumers on Level 4. Only a few start-ups in the last decade have been able to reach a wide segment of society —Whatsapp, Google and Youtube are examples.

Start-up founders should focus on the right businesses and consumer segments and not create copycat models from the United States or other Western countries, which are too rich to serve as effective models. Indian start-up founders will need to be creative about how to expand their customer-base. One source of inspiration may be to look at how Chinese start-ups address Level 2 and 3 consumers currently and how this could be adapted to the Indian context.

The growth potential in India in the coming decades is huge. While India is a unique diverse market, with its inherent challenges, if tapped properly, the upside is tremendous.